When procurement teams ask, “Who are the best cookware companies?” they usually expect a ranked list. That answer is incomplete, honestly. In a mature industry, best depends on the role the company plays in the value chain.

In this article, Chances, a professional wholesale cookware manufacturer, reframes “the best cookware companies”: rather than naming winners, it describes the company types that dominate specific commercial needs—and explains how buyers should match those types to their objectives.

Table of Contents

ToggleWhy Role Matters More than Reputation

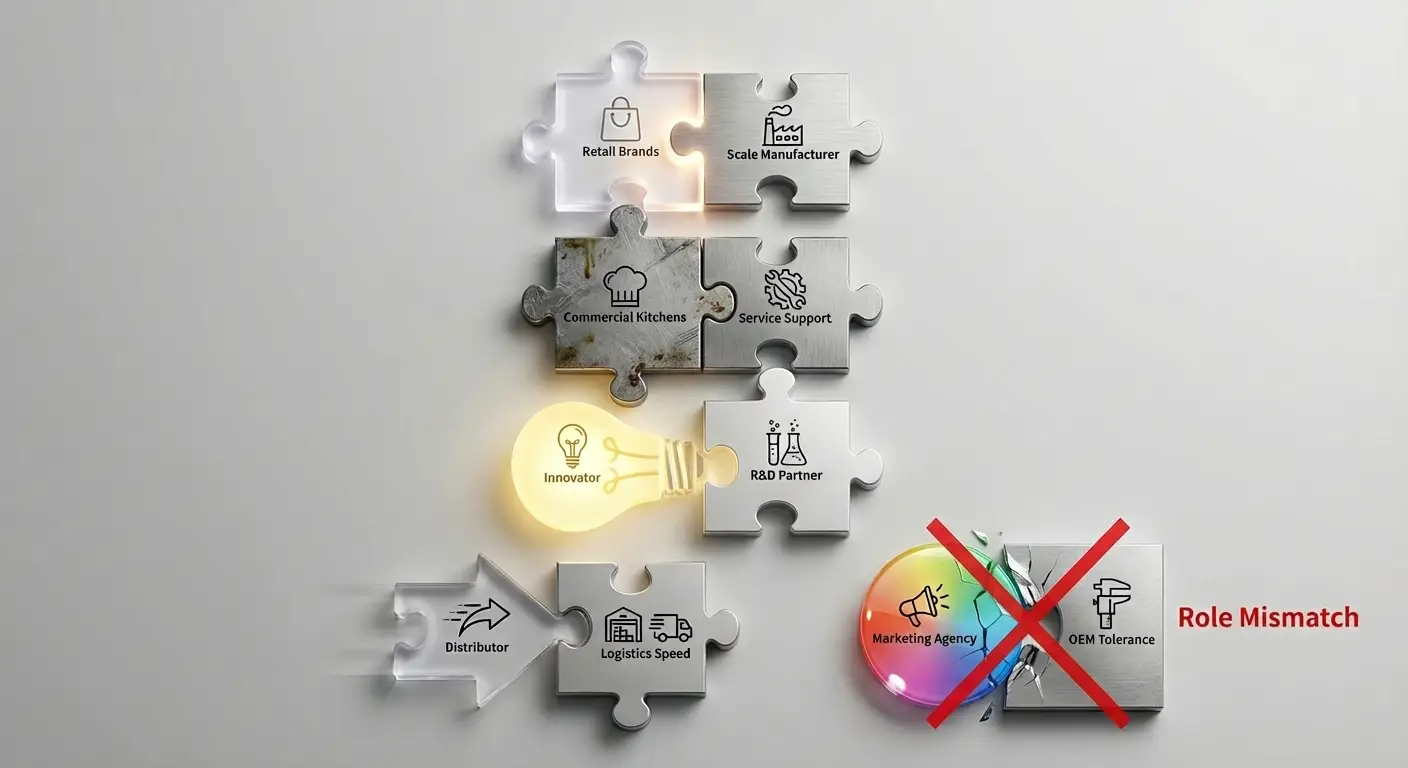

Cookware demand is multi-dimensional: design and brand, manufacturing and scale, material innovation, and distribution reach each solve different buyer problems. A firm that is “best” at consumer marketing may not be the right partner for a private-label program that requires deep manufacturing expertise. For B2B buyers, the practical question becomes: which company role aligns with my operational objectives?

Four Company Types That Define the Market

Below are the four archetypes you will encounter. Each represents a legitimate definition of best—but in different contexts.

1. Brand-Driven Companies (consumer & retail leaders)

Strengths: product design, channel control, marketing, and strong retail placement.

When they are best: consumer-facing retail assortments, premium positioning, and co-branding programs.

Why: they command shelf visibility and can drive higher ASPs, but often outsource manufacturing and trade off unit cost control.

2. Manufacturing-Driven Companies (industrial and OEM powerhouses)

Strengths: process control, scale, cost optimization, consistency.

When they are best: large-volume private-label orders, industrial/commercial cookware, and complex multi-layer production (tri-ply, clad).

Why: they own critical processes—cladding, toolmaking, finishing—which reduce variability and improve lead-time predictability.

3. Innovation-Driven Companies (materials & tech leaders)

Strengths: R&D, new coatings, novel alloys, and advanced surface treatments.

When they are best: premium or specialty SKUs where performance differentiation matters (induction-ready systems, honeycomb surfaces, PVD finishes).

Why: they validate new concepts that can win niche markets, though scaling cost-effectively can be a challenge.

4. Distribution-Driven Companies (logistics & assortment specialists)

Strengths: inventory, multi-region distribution, rapid fulfillment, and SKU breadth.

When they are best: regional rollouts, omnichannel retail, and clients that prioritize fast replenishment and broad SKUs rather than manufacturing uniqueness.

Why: They simplify commercial logistics but typically compete on availability rather than technical leadership.

What “best cookware companies” Means for Different B2B Buyers

Match company type to buyer need:

- Retail brands & wholesalers: Often combine brand-driven design with manufacturing-driven partners. Look for manufacturers that can execute to brand aesthetics at scale.

- Commercial kitchens & hospitality: Manufacturing-driven firms with heavy-gauge production and service support are best—durability and spare-part availability matter most.

- Innovative product lines: Work with innovation-driven partners for R&D, then scale with manufacturing-driven firms.

- Regional distributors: Distribution-driven companies reduce working capital and speed to shelf.

Understanding these roles prevents “role mismatch” purchases—e.g., hiring a marketing-led brand company to fulfill strict OEM tolerances, or expecting a volume manufacturer to lead product innovation.

How Top Companies Structure Themselves

The most reliable firms—those you may consider among the best cookware companies for your needs—share a common architecture:

- Clear product segmentation: Separate lines for entry, mid, and premium channels simplify pricing and tooling amortization.

- In-house critical processes: Ownership of core steps (cladding, progressive die tooling, high-precision polishing) reduces quality risk.

- Robust QA & compliance: IQC/IPQC/FQC flows, batch CoA, and scheduled third-party testing support regulated exports.

- Scalable R&D & pilot capacity: Rapid prototyping linked to pilot production avoids late surprises in tooling.

- Commercial discipline: Transparent costing, MOQ tiers, and spare-part policies enable predictable operations.

These structural traits are practical indicators in supplier due diligence.

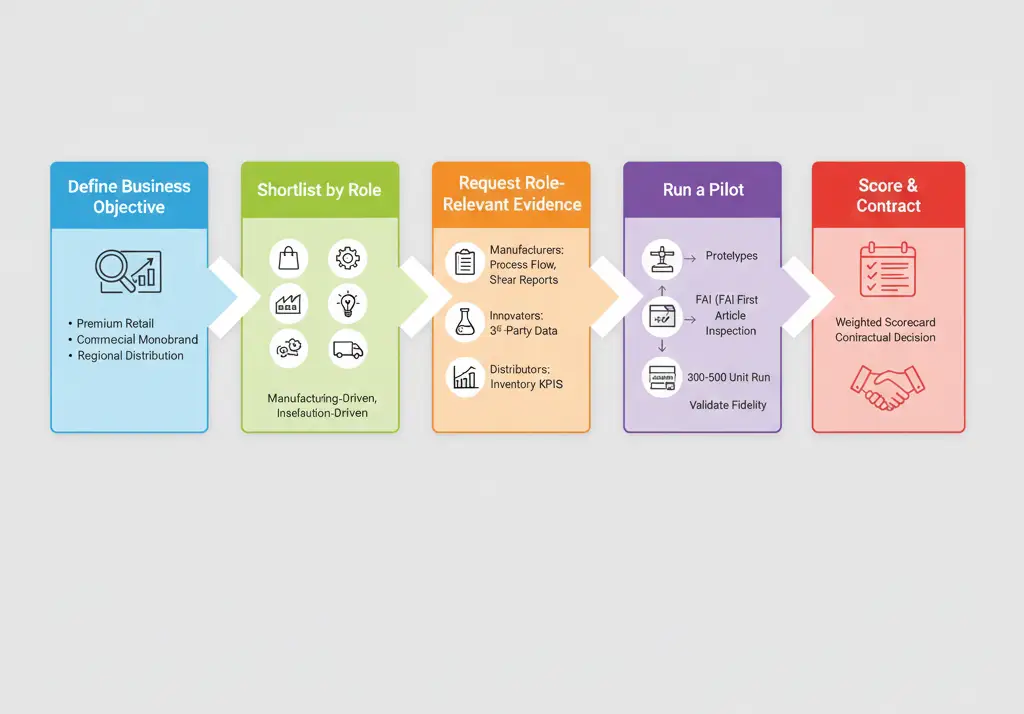

A Pragmatic Evaluation Workflow

Operationalize the role framework with these steps:

- Define business objective (e.g., premium retail, commercial monobrand, regional distribution).

- Shortlist by role (brand-driven, manufacturing-driven, innovation-driven, distribution-driven).

- Request role-relevant evidence (for manufacturers: process flow diagrams, cladding method, peel/shear reports; for innovators: third-party performance data; for distributors: inventory KPIs).

- Run a pilot: prototypes → FAI(First Article Inspection) → 300–500 unit pilot run to validate mass-production fidelity.

- Score and contract: Use a weighted scorecard to convert qualitative fit into a contractual decision.

Apply this workflow, and your procurement team will select a partner that behaves like one of the best cookware companies for your objectives—measured, not claimed.

Common Mistakes Buyers Make

- Equating brand fame with manufacturing competence. Brand recognition does not guarantee production quality or capacity.

- Using samples as proof of mass-production stability. Hand-finished samples often mask scale problems.

- Expecting a single partner to excel at all roles. Multi-role expectations increase cost and delivery risk.

Avoid these errors by mapping desired outcomes to the company’s role before negotiations begin.

Conclusion: choose a role, then a partner

There is no universal champion among the best cookware companies—only companies that are best at particular roles. For effective B2B sourcing, define the role your partner must play, validate that role with evidence, and then proceed with pilot-validated contracts. This approach turns an ambiguous procurement question into a strategic match: role clarity reduces risk, shortens time-to-market, and aligns supplier incentives with your commercial goals.

About Chances

Chances is a top stainless steel cookware manufacturer and is one of the best cookware companies with in-house production capabilities that support both scale and precision. Built on a strong manufacturing foundation, we translate brand aesthetics into practical cookware designs while actively exploring new structures, finishes, and applications. Our team works closely with partners to deliver custom stainless steel cookware solutions that balance visual identity with real-world performance. All manufacturing operations follow internationally recognized safety and quality standards, ensuring stable output and long-term reliability for global markets.